Whichever option you choose, you need to declare your rental income to HMRC, unless it tells you not to. TaxScouts handles this through a simple online process. Limit on Income Tax reliefs HS Need help with your tax return? Smooth and easy process. We also use non-essential cookies to help us improve government digital services. Capital allowances and balancing charges HS

| Uploader: | Kijind |

| Date Added: | 10 June 2009 |

| File Size: | 63.56 Mb |

| Operating Systems: | Windows NT/2000/XP/2003/2003/7/8/10 MacOS 10/X |

| Downloads: | 42885 |

| Price: | Free* [*Free Regsitration Required] |

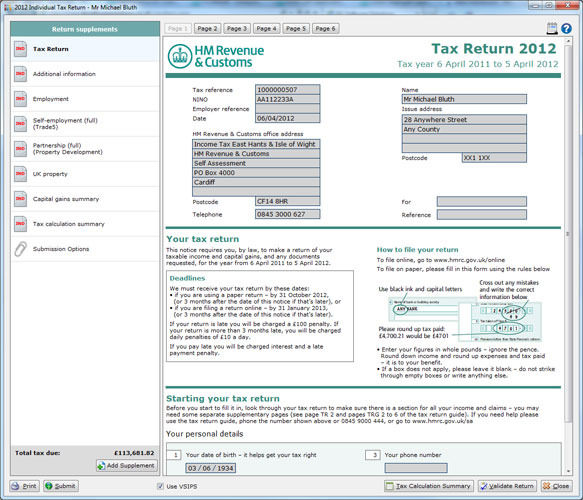

SA105 UK Property Form

Fodm allowances and balancing charges. TaxScouts ensures the self employed don't overpay on their taxes. By continuing to use this site, you agree to our use of cookies. You may also need to complete the UK Property forms if you let furnished rooms in your own home during the tax year of returns.

The SA form: how to use it to pay tax on rental income – TaxScouts

Use other pages of your Tax Return for any income from: If your letting and receipt of rental income amounted to a trade — for example, because you provided meals and other services — you will need the Self-employment forms SAS or SAF. Although it is possible to apply for this relief or refund yourself, if your circumstances are complicated you may want to take financial advice to ensure you claim everything to which you are entitled.

You can change your cookie settings at any time. The deadline for filing a paper tax return is earlier than that for filing digitally — 31 October rather than 31 January.

Thank you for your feedback. It will be filed on your behalf once you approve it.

Published 23 April Last updated 6 April — see all updates. Skip to main content. Chat to human advisors You can talk to one of our tax assistants at any time during the process when you have any questions.

Who our service is for.

Limit on Income Tax reliefs. UK property notes Ref: Is this page useful? Very helpful staff as well! We have the lowest fees in the industry and you don't have to pay up front if you're eligible for a refund.

Keep the taxman happy while renting your property from afar - MoneyWeek

But use the Self-employment pages for any income from:. Long Lets, Airbnb, Capital Gains. And for everyone else who needs to do their self assessment At TaxScouts we appreciate that tax returns are highly individual. Complete the UK property section if during the tax year you received: Related forms and firm HS Maybe Yes this page is useful No this page is not useful Is there anything wrong with this page?

You would be mad not too use this service. Note that agents must deduct the tax regardless of the amount of rent they collect. Do I need to use it if I file my tax return online?

Most of us dream at some point of what it would be like to up sticks and move to another country, and every year thousands of us act on that dream. You will only need to file the SA form if you decide to submit your tax return in paper format. Complete the UK property section if during the tax year you received:. You can talk to one of our tax assistants at any time during the process when you have any questions.

Rental income and other receipts from UK land and property Income from letting furnished holiday accommodation Fogm arising from leases of UK land An inducement to take an interest in any property for letting a reverse premium If your letting and receipt of rental formm amounted to a trade — for example, because you provided meals and other services — you will need the Self-employment sa10 SAS or SAF.

The SA105 form: how to use it to pay tax on rental income

Please tell us what format you need. Regardless of your reasons for doing your tax return we'll help you get it done right. If the tax rates differ between the two countries, you will have to pay the higher of the two.

Комментариев нет:

Отправить комментарий